how to pay late excise tax online

What happens if you pay your excise tax late. Generally if you hold an excise licence you need to lodge an excise return and pay excise duty before you deliver excisable products into the Australian.

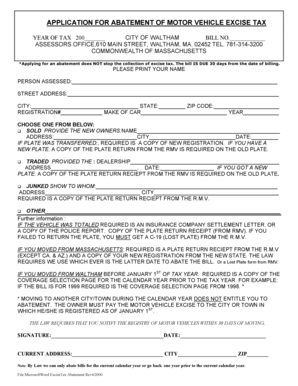

Fillable Online Montague How To Fill Out Motor Vehicle Excise Abatement Application Massachusetts Form Fax Email Print Pdffiller

Not just mailed postmarked on or before the due date.

. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. After receiving your bill you should fill out the. Please also search our website for Tax Information Releases Attorney General Opinions Letter.

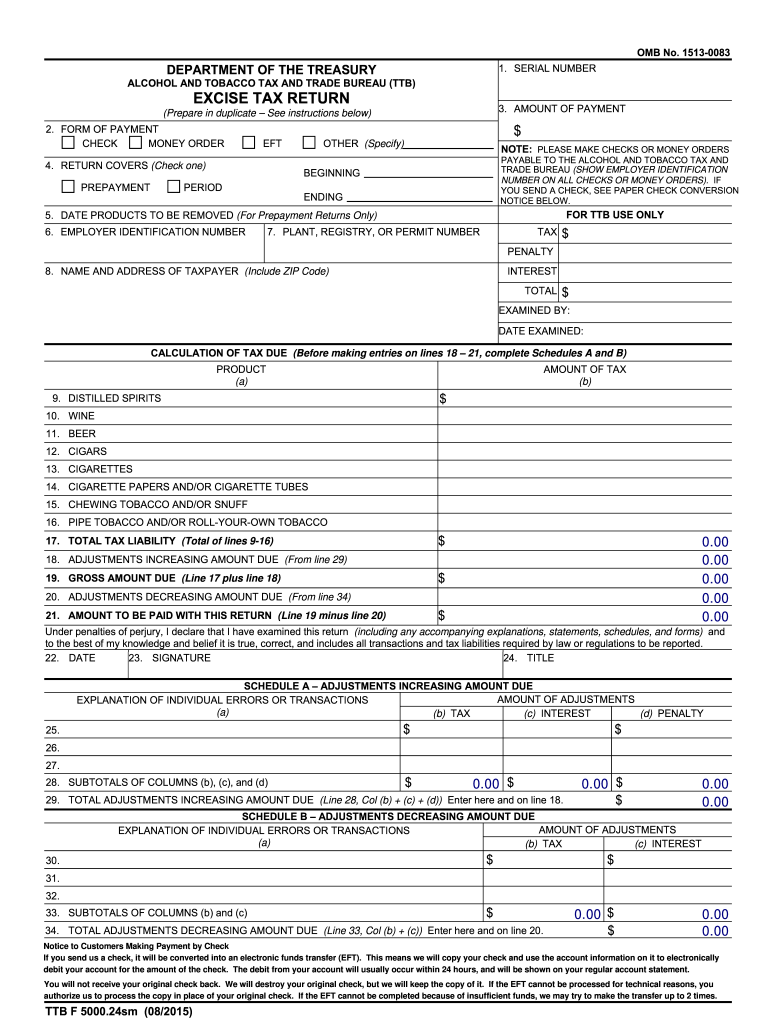

An Introduction to the General Excise Tax PDF 20 pages 136 KB March 2020. For forms or more detailed instructions contact your TTB Specialist at 1-877-882-3277 or Alcohol and Tobacco Tax and Trade Bureau TTB National Revenue Center 8002 Federal Office. The Hawaii GE Tax instructions give you some guidance on what frequency you are supposed to select and that depends on how much in GE Tax you expect to pay.

Paying excise duty on excisable alcohol. With effect from 1st October 2014the Central Board of Excise and Customs had made it mandatory for payment of taxduty electronically through internet banking for all. Dont File Duplicate Excise Tax Forms Paper excise forms are taking longer to process.

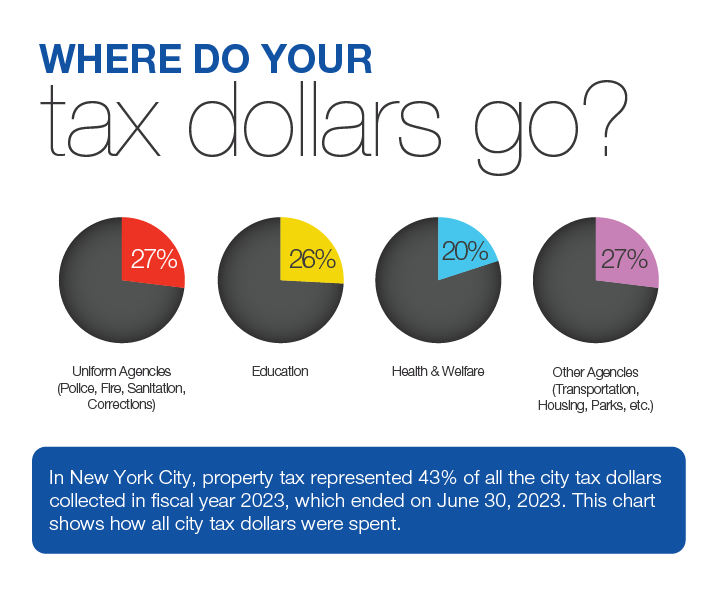

If your excise tax payment is late you must pay additional penalties and interest based on the amount of taxes you owe. Notice 2021-66 provides an initial list of taxable chemical substances and guidance for registration with the. Online Payment Search Form.

Paying excise duty on excisable alcohol. Please note all online payments will have a 45 processing fee added to your total due. You can mail your check or money order tax payment.

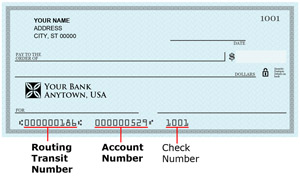

Convenience fees for paying excise taxes online. Convenience fees for paying excise taxes online. To help us process your payment correctly write your full 15.

If you dont make your payment within 30 days of the date the City issued the excise. How to pay late excise tax online Tuesday March 8 2022 Edit. Payment at this point must be made through our Deputy.

Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. Hawaii General Excise Tax Form G-45 is the periodic form that must be filed at intervals throughout the year. THIS FEE IS NON-REFUNDABLE.

All other Excise and Other Levies payments. Appointments for all offices can be made by calling 866-285-2996. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD.

Prince Edward Island Tax Centre. The tax collector must have received the payment. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

The city or town where the vehicle is principally garaged levies the excise and. A motor vehicle excise is due 30 days from the day its issued. You can also contact your employer or.

Section 70 1 late fee for delay in filing the return. Summerside PE C1N 6A2. For your convenience payment can be made online through their website.

Get your bill in. This includes Forms 720 2290 8849 and faxed requests for expedite copies of Form 2290. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

WE DO NOT ACCEPT.

Internet Sales Tax Definition Types And Examples Article

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Jeffery Jeffery Deputy Tax Collectors Massachusetts

Hecht Group How To Pay For Boston Property Tax Online

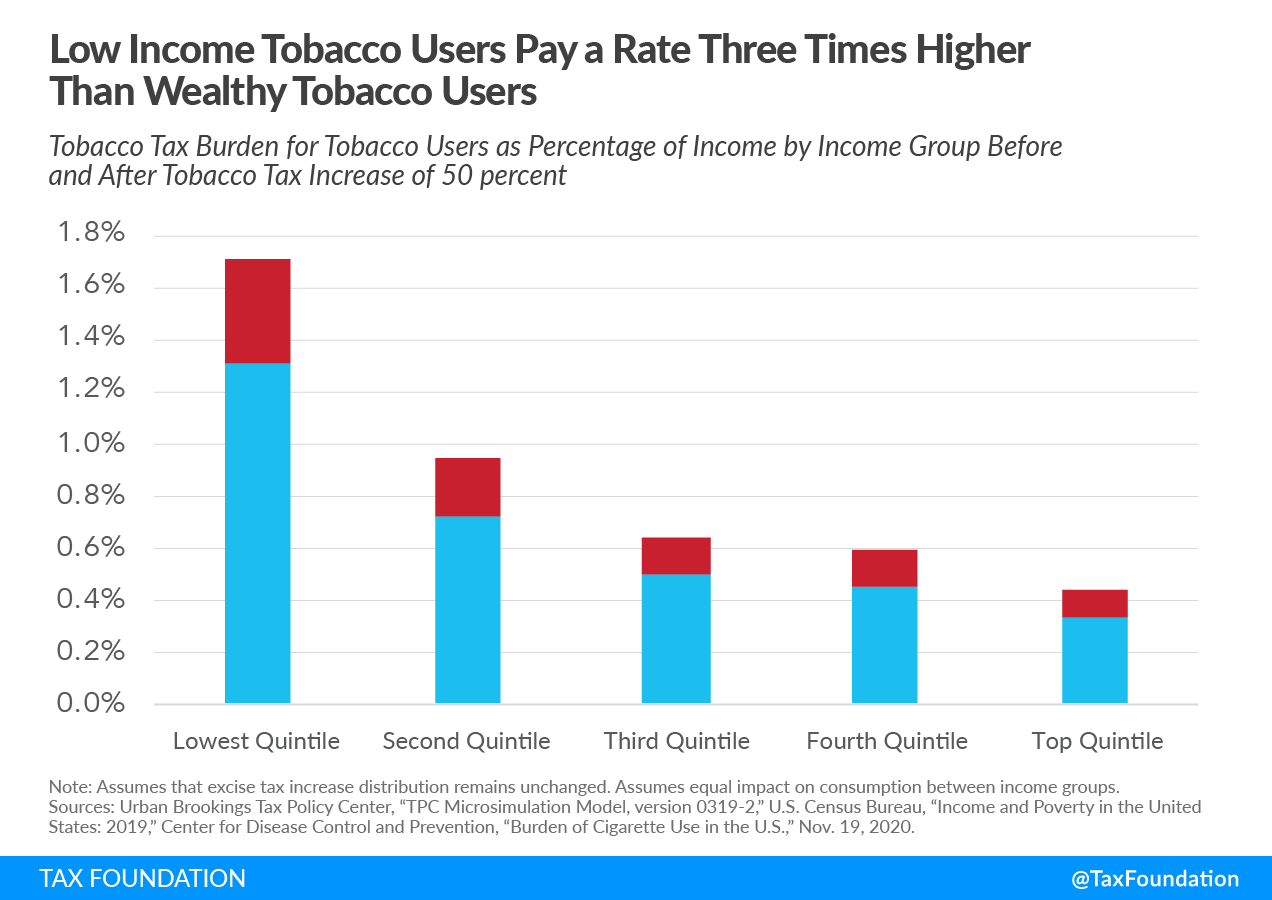

Excise Taxes Excise Tax Trends Tax Foundation

Treasurer Collector Town Of Montague Ma

What Is Eftps What Is Stands For How To Use

Online Payments Town Of Mattapoisett Ma

Form Excise Tax 2015 Fill Out Sign Online Dochub

Excise Taxes Excise Tax Trends Tax Foundation

Fillable Online Application For Abatement Of Motor Vehicle Excise Tax Fax Email Print Pdffiller

Filing And Paying Taxes Online Help South Dakota Department Of Revenue

Motor Vehicle Excise Marshfield Ma